Council Tax Charges, Valuations and Spending

Planned Spending and Your Council Tax

We collect council tax on behalf of government organisations in the area. These include:

- Lancashire County Council

- Lancashire Police and Crime Commissioner

- Lancashire Fire and Rescue

- Local Town and Parish Councils

- and ourselves, Ribble Valley Borough Council.

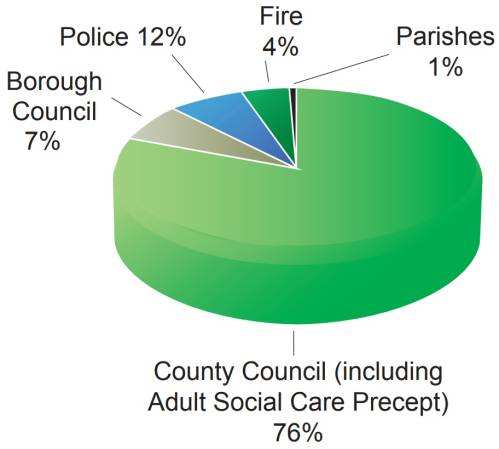

The chart below shows how your annual council tax bill is divided across different local organisations.

The amount of council tax you pay depends on how much the organisations above need to spend to deliver services in the area, and how much money they get from elsewhere. The amount you have to pay also depends on which valuation band your home is in.

Each parish or town council within the borough can request a share of council tax for the local services provided by them. A table of council tax charges by parish for 2024/2025 is available for download.

You can also download information about how each organisation uses their share of council tax:

- Ribble Valley Borough Council council tax information

- Lancashire County Council council tax information

- Police and Crime Commissioner council tax information

- Lancashire Fire and Rescue Service council tax information

- Clitheroe Town Council

Adult Social Care charges explained

There is no longer a requirement to show the Adult Social Care charge separately on the bill, so the percentage change for Lancashire County Council shows the difference between the two elements shown on last year’s bill and the combined amount on this year’s bill.

For more information on the Adult Social Care Precept see Lancashire County Council Council Tax.